Housing Trust Funds

Housing trust funds were first developed in the 1970s and became more common in the 1980s and 1990s. In Massachusetts, it was after the passage of the Municipal Affordable Housing Trust (MAHT) statute, M.G.L Chapter 44, Section 55c, in 2005 that cities and towns began to more actively create housing trust funds. Today, more than 100 communities in the state have a local affordable housing trust fund.

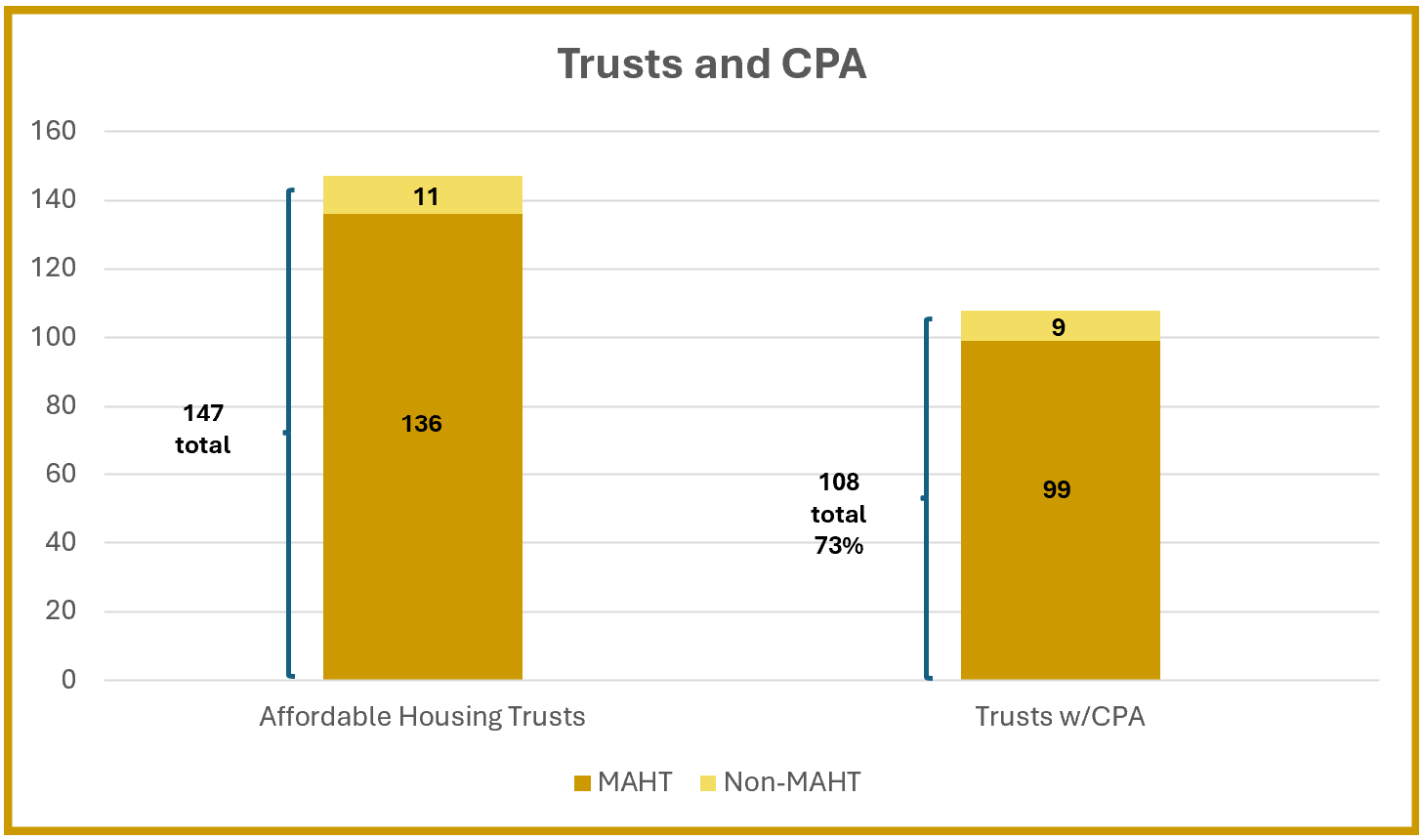

The popularity of housing trust funds has coincided with the local passage of the Community Preservation Act (CPA). Almost 73% of communities that have created a housing trust fund have also adopted CPA. Ideally, the housing trust fund and community preservation committee (CPC) work collaboratively, along with other boards and departments, to address local affordable housing needs.

Most housing trust funds in Massachusetts are municipal entities focused on creating and preserving affordable housing, generally described as housing for household earning up to 100% of the area median income (AMI). Commonly referred to as "housing trusts", these entities are similar in structure with some variation in powers granted and trustees appointed to manage the fund.

About a dozen housing trust funds were created through special legislation under home rule petition, before the MAHT statute was passed. A few are not connected to the municipality or focus beyond affordable housing.

Board of Trustees

A housing trust fund organized under M.G.L Chapter 44, Section 55c, must have a minimum of 5 trustees, including the community's chief executive officer. In communities where the chief executive officer is a multi-member board (e.g. Select Board) the board shall designate a minimum of one member to serve as a trustee. Terms are set at 2 years and often staggered. Appointments are made by the mayor or manager in a city or town, subject to confirmation by the city council or select board.

Many communities opt to have more than 5 trustees and there is wide variation in who is appointed. Some communities specify in their ordinance or bylaw that trustees should have specific work experience or sit on other local boards. Other communities simply pass the MAHT statute as it is written. Still, others have a mix of wide open seats and more directive guidance for appointments.

Housing Trust Funds Powers

Sixteen powers are given to housing trust funds in the state statute. Occasionally, a community may create a housing trust fund with some restrictions on powers such as requiring a two-thirds vote of the trustees to purchase or sell a real property interest. The statute also allows a community to omit or modify powers, as well as grant additional powers. See a full list of powers here.

Sources of Funding

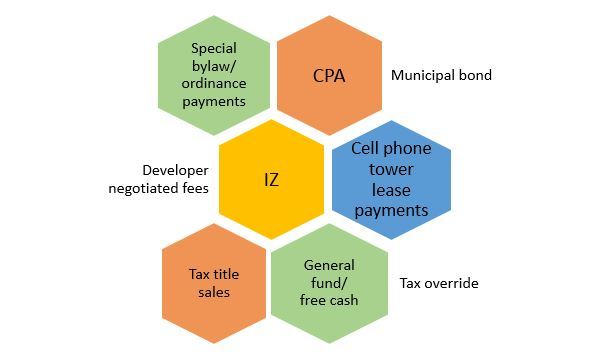

Communities have created many ways to capitalize their housing trust funds. While CPA remains the most common resource, in 2017 the town of Medfield bonded $1 million (without CPA) to fund their newly created housing trust fund. Then in 2018, we saw the first tax override of $275,000 in Orleans to fund their new municipal affordable housing trust fund. Additionally, several communities direct inclusionary zoning “in lieu” of payments to their housing trust funds and some have transferred “free cash” to the trust fund.

The most active and successful housing trust funds tend to have a variety of funding sources that allow them to have a steady flow of financial resources to work with. For housing trust funds that receive CPA resources, an annual report must be submitted to the local Community Preservation Committee (CPC) to outline how the trust allocated CPA funds during the past year. The CPC then reports this data to the Department of Revenue (DOR) in their annual CP-3 report due September 15.

Use this form to report to your local CPC. These directions will assist you in completing the form.